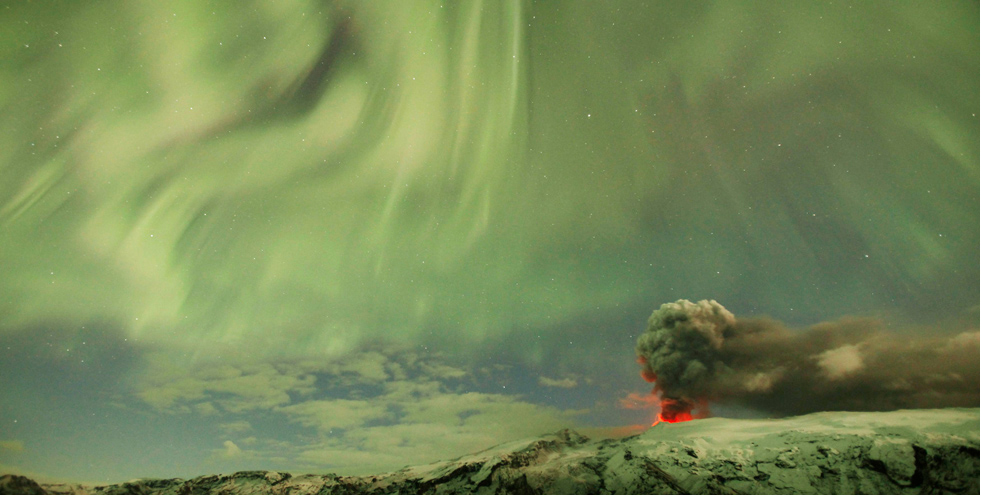

This photo of auroras over Iceland’s volcano is just freakin’ gorgeous. Hat tip to @Eloren and @inveve.

the good news on maternal mortality, and the politics of aid

A good discussion in the Columbia Journalism Review on science versus advocacy, on the heels of The Lancet’s piece on declining Maternal Mortality Rates (MMR) worldwide (using new, more rigorous modeling on countries with estimates available):

On Wednesday, The New York Times gave its lead front-page slot to a study published in the medical journal The Lancet, where, “For the first time in decades, researchers are reporting a significant drop worldwide in the number women dying each year from pregnancy and childbirth, to about 342,900 in 2008 from 526,300 in 1980 … The study cited a number of reasons for the improvement: lower pregnancy rates in some countries; higher income, which improves nutrition and access to health care; more education for women; and the increasing availability of “skilled attendants” — people with some medical training — to help women give birth.”

…most articles took a pass on [The Lancet editor] Horton’s comments about pressure from advocacy groups. One exception was the Associated Press, which mentioned it right in the lede (although, curiously, a headline on an early version of the story that read “Politics of aid seen in clash over maternal deaths” was later changed to “Lancet: Sharp drop in maternal deaths worldwide”).

Unfortunately, the AP had nothing to add on the extent to which advocates are actually concerned about the political (read: financial support) ramifications of the statistics presented in The Lancet. What the article, by Maria Cheng, does mention is that “A separate report by a group headed by the United Nations reached a very different conclusion on maternal mortality, saying the figure remains steady at about 500,000 deaths a year.”

…Ultimately, Horton concluded, “given the dramatic difference” between the results of the Lancet study and those reported by the U.N. in 2008 (pdf), which found that little progress had been made toward reducing maternal mortality, “a process needs to be put in place urgently to discuss these figures, their implications, and the actions, global and in country, that should follow.”

on Iceland

I feel terrible for laughing but…

Iceland. First they go bankrupt & now they set their island on fire. Anyone smell insurance scam?

David Frum on bailouts

David Frum explains bailouts:

Senate Minority Leader Mitch McConnell has accused the Obama administration, Sen. Chris Dodd, and, by implication, most other Democrats of plotting for permanent bailouts of the financial system. He’s right. But Democrats can rightly point out that McConnell, every other member of Congress, and, indeed, just about every American citizen, want the same thing.

…

A bailout, of course, is what happens when the government keeps an explicit or implicit promise to stop an institution from failing or a financial instrument from loosing its value. And these guarantees are very common: many widely owned products—savings accounts, certificates of deposit, pensions, retail brokerage accounts, and admitted market homeowners insurance—all have attached guarantees. In many cases, people even use different names for guaranteed and non-guaranteed products: a CD without a government guarantee is called a bond, property insurance without a guarantee is called an excess and surplus lines policy. One expects that these guarantees will eventually be needed: there wouldn’t be a point in offering them if they weren’t. So, as long as the government guarantees any financial instrument, in short, it will engage in bailouts. The only true “no more bailouts” policy would involve abolishing the Federal Deposit Insurance Corporation, the Securities Investor Protection Corporation, more than 50 state insurance guarantee funds, the Pension Benefit Guarantee Corporation, the National Credit Union Share Insurance Fund and at least a half dozen other entities.

…

Even if this were a good idea, it probably wouldn’t get a single vote in Congress. Among other things, abolishing all public-sector guarantees would upend the business model of nearly every financial services firm in the country, lead some families to financial ruin, and end the sale of certain products. In short, while proposing an end to all guarantees may make good fodder for dorm-room bull sessions, it will never go anywhere.

Any practical look at policy towards bailouts should focus on how to limit them.

This means the government should get out of some guarantee businesses altogether, avoid entering new ones, and enforce regulations to minimize the need for those guarantees that can’t go away.

visual CV

While CVs are oftentimes irrelevant these days, it’s still a good idea to have a current one. I find the traditional layout a little disjointed, so I played a little with placing work, education and activism on a timeline. Here’s a first draft I’m still playing with. It can be viewed at higher resolution on Flickr. Note: Updated the CV current to Jan 2011.

the end of the “Third World”

World Bank president Robert Zoellick states the obvious. But the economic crash only highlighted this geo-economic shift, it did not precipitate it.

“If 1989 saw the end of the ‘Second World’ with Communism’s demise, then 2009 saw the end of what was known as the ‘Third World’. We are now in a new, fast-evolving multi-polar world economy in which some developing countries are emerging as economic powers, others are moving towards becoming additional poles of growth, and some are struggling to attain their potential within this new system – where North and South, East and West, are now points on a compass, not economic destinies.”

“If it is no longer possible to solve big international issues without developing and transition country involvement, it is also no longer possible to presume that their biggest members, the so-called BRICs – Brazil, Russia, India, and China – will represent all,” he said.

The more interesting part:

Asia’s stock markets now account for 32% of global market capitalization, ahead of both the US and the European Union, and that its share of the global economy in purchasing power parity (PPP) terms has risen from 7% 30 years ago to 21% in 2008.

The developing world as a whole has increased its share of global GDP in PPP terms from 33.7% in 1980 to 43.4%, according to Zoellick, who said sub-Saharan Africa and South Asia could grow by over 6% over the next five years.